Pre-qualified investor leads indicate those individuals or organizations who get interested in the investment opportunity attracted by the content retailing process, screened with specific criteria where the whole process is managed in a confidential manner.

In today’s marketing world, especially in the finance and investment industry, investor leads are crucial. Here, to cope with the vast competition, only pre-qualified investor leads, also known as pre-qualified investor lists, can save you.

Owning a business is not easy if you do not have qualified investor leads. This may snatch your peace since it is about millions or billions of investments. But the right place you are in.

Today, we will give you a brief understanding of pre-qualified investor leads, why you should invest in the process, and the steps you can take for the qualification.

Lastly, the benefits and common mistakes you should consider so there is no stone left unturned regarding investor leads.

Understanding Pre-Qualified Investor Leads

In the big ocean of thousands of dormant consumers, partnership with potential investors is not a nightmare anymore with pre-qualified investor leads.

Pre-qualified investor leads are the filtered-out entities that fit into specific parameters set by the seller company. They are used primarily in the context of investment and fundraising.

More precisely, qualified investor leads are the identification of individuals who have the interest and authority to purchase or are involved in the investment opportunity. Companies use a compiled list for qualification.

They fill the sales pipeline with accredited investors in a millionaire. Marketers can streamline their marketing efforts and maximize the chance of getting potential investors.

Reaching the exact investors who are most likely to become real investors is the only key secret here.

But one point to be noted is that pre-qualified investors only squeeze the way of getting potential leads. This is not a guaranteed path where they must invest.

However, the whole process depends on several criteria, such as;

- Accredited Investor Status

- Investment Preferences

- Geographic Location

- Relationship with Financial Institutions

- Compliance

Tips: It can be hard to maintain business confidentiality while reaching more investors. This can showcase a negative impression in the whole marketplace. So, it is best to provide confidential papers only to sold leads that go through all along the parameters.

Why You Should Invest in Pre-Qualified Investor Leads?

Who does not like to have time and cost-effective marketing where the chance of conversion rate is higher? Investing in pre-qualified investor leads brings all of these to your plate with additional benefits.

For example, before initiating your business proposal to someone or a B2B appointment setting, if you know the highly qualified leads already, then there is more possibility to close the deal. This is no different for those engaged in fundraising, financial services, or investment.

Let us break down the reasons why you should consider investing in pre-qualified investor leads.

- Pre-qualification lets you entice a targeted audience. You only need to invest in a specific list of investors, so reaching investors relatable to your niche becomes more reliable and more accessible.

- Instead of reaching out to an unfiltered audience, working with pre-qualified leads saves time. You and your team can avoid wasting effort rather than concentrate on who is more likely to be receptive.

- You are putting your money on some specific investors who are already qualified, saving a lot of bucks from your pocket.

- Already screened and deemed investors are more likely to convert into those putting money into your business.

- In case you are expanding your business or launching something, investors lead a list of only ways to get capital.

- Reduce the risk of dealing with investors who may not have the means or desire to participate fully.

Tips: Effective communication with transparency is crucial. Adhere to legal and ethical standards; also, the deal should be with reputable sources.

The Process of Generating Pre-qualified Investor Leads

While learning about the process of generating pre-qualified leads, you will come across numerous ways. And it can be challenging for you to ride on the exact method.

This is why we narrow down the whole process into three fundamental parts: sourcing, filtering, and then segmentation. Whatever path you choose, you must go through these three fundamental steps.

We have further yield deep in the whole process so you can better get guidance. There are small pre-qualification questions also, and you better give answers to them yourself.

1. Sourcing

This is the initial phase and, most importantly, to find out your potential investing partners. Proper implementation of this step will flow toward the next successful stairs.

For seeking potential clients, many inbound and outbound telemarketing prove to be very efficient. Apart from this, there may be some dedicated team members working simultaneously to snatch leads from various sources.

Walk along the micro stairs we have shown for an effective sourcing technique.

-

Define Your Target Investor

While you may be thinking, defining target investors is not relatable with sourcing. Instead, you may focus on a broad community, and this is where you are stepping into a big mistake.

Lead investors are far different from any business or general client. Investors need to support a with significant capital, and most of the leads fail to fill up this criteria.

Not all demographic or certain areas investors can stand to your financial expectations. So, when you are starting with finding a source, fix a couple of target areas by considering their income, net worth, investment goals, and investment experience.

Such as, “Who are you looking for? High-net-worth individuals, venture capitalists? Do they have a specific geographic preference?”

-

In-House Database

It is best if you keep a database of all your client’s businesses for future use. Ask for “How can you reach out to potential investors? Email, phone, social media? Do you have a reliable source for their contact info?”

This can help more quickly than looking for a needle in a haystack. When you need investor leads, just check your database, and you are good to go.

-

Networking Events, Utilize Social Media Engagement

Attending industry events, seminars, and conferences lets you meet new people and know about them. The wider your networking, the bigger the chance of being able to communicate with you.

Here, social media is a powerful weapon, such as Linkedin, Fiverr, and Upwork, for reaching only professional investors. This actually narrows down the search a lot.

You can even contact your investor’s next-door neighbors, their neighbors, and so on.

-

Engagement and Education

The more eyes can know about your proposal, the more you can get highly qualified leads. In such cases, professionals’ emails, cold calls, and physical or virtual conferences can help best. Or an appointment setter can schedule these meetings. Then, you can share insights about investment opportunities, potential risks, or some recommendations, how both of you can get profit, and so on. In simple terms, engage, then educate.

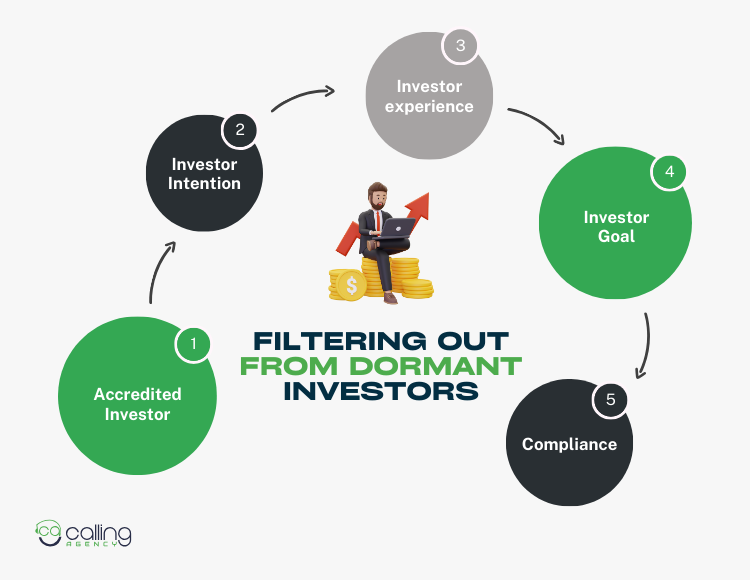

2. Filtering

Filtering or screening for eligibility is the center point where you will qualify the potential investors from your unfiltered list. This step involves the questioning phase, investigation of the solid information, and other legality. Since it is related financially, you do not want to interrogate any fraud.

Sieve all the leads into your final list according to the parameters below.

-

Accredited Investor Status

Accredited investor status is not a new term for those who are looking for investor leads.

An accredited investor is defined as someone who meets certain income or net worth requirements. It measures the financial capability of your investor partner.

One example can be, in the United States, an accredited investor’s annual income should be at least $200,000 or a net worth of at least $1 million. Your specific state, country, or location must have some pre-set financial capabilities. The investor needs to align with these criteria first.

Accredited investors typically have a higher income or net worth than the general population.

Only these investors are allowed to participate in certain types of investments that are not available to the general public due to their presumed financial sophistication.

For the qualification process, start with “ What is the investment budget? Can they afford the minimum investment required? Are they looking for short-term or long-term opportunities? ”

-

Experience and Sophistication

The experience of your investor leads related to your business is crucial. Their experience can impact your whole business as you are not dealing with general individuals. These leads will be a part of your board and will be making important decisions. Or, in case you want to handover the whole business, there should be a high level of experience and sophistication.

You can primarily seek two answers;

- Does the lead have any experience in the industry, or have they held any managerial positions in the past?

- Are they planning to run the business themselves, or do they intend to keep the current management?

-

Legal and Regulatory Compliance

In the pre-qualification investor leads process, you can not neglect a pinch into legal and regulatory compliance. Otherwise, this can bring you a considerable loss. Stay keenly focused on privacy and data protection laws, give your lead confidential paper to sign, provide specific legal criteria, and fulfill all other laws. It is best to consult with a lawyer who can manage all these for your company. There will be no chance of being deceived.

Must ask or be clear with your investment partners, “ What’s their professional background? Are there any red flags or ethical concerns? Are they aware of and compliant with all legal requirements for investing? “

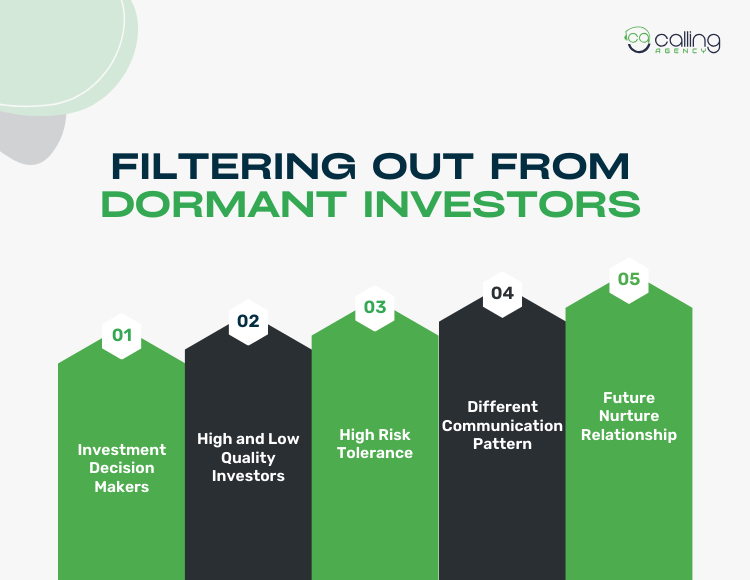

3. Segmentation

The third and final step in pre-qualified investor leads is segmentation. This is a clever way to reach high-quality leads first because you want quick results on your ROI.

This is, again, beneficial because not all leads will be equally interested in the investment preferences. Some may want to spend on a particular product, others are capable of investing massively, while the rest may invest later.

Segmentation can pictorise the whole situation at a glance. You can better screen with your set of criteria.

This segmentation allows you to tailor your communication and offerings to each group.

-

Categorizing Investors

Some investors would be immediately ready for the partnership, while others may need more push. Also, some have more capital to invest. According to these, you can categorize them as high and low-qualified leads.

Make a list of who wants to sink money in your whole business, on a single or multiple products, or in a specific area. You can then initiate your proposal before them. This is a more organized way to rely on. Moreover, these questions can help you,

- How do they make investment decisions? Are there any decision-makers involved?

- Do they have any specific terms or conditions for investing?

-

Risk Tolerance

“ How comfortable are leads with risk? Are they conservative or more adventurous?

Have they invested in high-risk ventures before? “

Categorize leads based on their risk tolerance, as some may be more willing to invest in high-risk ventures than others. Which would be best for you will depend on your company’s situation. If you are into some loss, then avoid any type of risk. For the big, profitable business, they can take a risk.

-

Communication Preferences

Communication preferences mean how your venture likes to contact you (e.g., email, direct calls, virtual meetings, or others). How often do they expect updates on their investments?

This division allows you to tailor your effort to the exact communication strategies aligned with the specific interests of each group. After finding out, “ Are investors comfortable with your communication style and frequency? “ You can allocate your sales team to the right group where they can show their expertise.

Here, regular interaction is vital so you do not lose your stakeholder to other competitors. Because they will divert for sure if they get more opportunities from others.

-

Nurturing Relationships

For the highly interested and qualified leads, you should focus on building and nurturing relationships. If they pass all your qualification criteria, then provide them with in-depth information, address all their concerns, and guide them through the whole investigation process.

Nurturing relationships is applicable for those who do not convert immediately but have the capability to share their money. In such a case, maintain consistency to inform them about your company, but do not promote disruption.

Make a short list of those, “ What’s the next step in the process after pre-qualification?

Are they interested in a follow-up meeting or further discussions? “

What Are the Benefits of Pre-Qualified Investor Leads?

The effectiveness of pre-qualified investor leads can vary depending on the industry, target audience, and the quality of the leads themselves. However, if you can get a list of pre-qualified investor leads, you can experience several of the benefits from it.

This process lets you customize your marketing efforts to better match the needs and interests of specific segments of your shareholders. Engaging with pre-qualified leads widens the chance to start building relationships in the early stage. This can lead to long-term partnerships and repeat investments.

Also, interacting with pre-qualified leads can provide valuable insights into investor sentiment, market trends, and the competition. This helps you refine your investment strategies.

By focusing on pre-qualified leads, you can maintain a positive reputation in the investment community. These leads can serve as word-of-mouth referrals and credibility.

Last but not least, pre-qualification investors lead a process assessed with several data privacy and protection laws, legal documents, and verification. This reduces the chance of being deceived, unlike following a non-strategic approach.

Common Mistakes Made In The Pre-Qualification Process

Some common mistakes that most businesses make while pre-qualification investors lead the process. Have a glance at them, and be prepared to prevent them in your approach.

- Skipping research means not investigating potential investors. By which you might waste time on leads who are entirely mismatched.

- Overlooking your own qualification criteria for a qualified investor.

- Using a generic pitch for all leads may not work for all investors.

- Ignoring warning signs or inconsistencies in the investor’s background, such as a history of unethical behavior or financial troubles.

- Rushing to move leads through pre-qualification too quickly. Expectation of immediate results.

- Failing to establish clear lines of communication.

- Neglecting follow-up contact with leads after the initial qualification.

- Not listening to feedback from leads who didn’t qualify.

- Being less focused on legal and compliance requirements.

Verdict

Not all investor leads have the ability to invest in business, except pre-qualified investor leads. The pre-qualification process involves several factors, where the investors need to align with the criteria.

This helps marketers or businesses to reach out only to potential investors, which is both time and cost-saving.

We have highlighted a detailed image of pre-qualified investor leads and benefits. Also, if you want an effective way to qualify them, our in-depth guidance on sourcing, filtering, and segmentation can better help you.