Merchant services providers face the challenge of not only acquiring new clients but also standing out in today’s crowded market. From payment processing to POS systems and value-added solutions, businesses have countless options, which makes effective marketing necessary.

The right marketing strategies help you build trust, communicate value, and attract merchants with higher demands. In this blog, we will show you the proven marketing approaches for merchant services that can increase visibility, strengthen client relationships, and drive sustainable growth.

Ideal Customer Profiles and Pain Points

Creating Ideal Customer Profiles (ICPs) and understanding customers’ pain points is very important in merchant services. Create ICPs by identifying demographics, firmographics, psychographics, and behaviors. Then address their pain points, which often include complex application processes, high rates, PCI compliance challenges, poor integration, and slow processing.

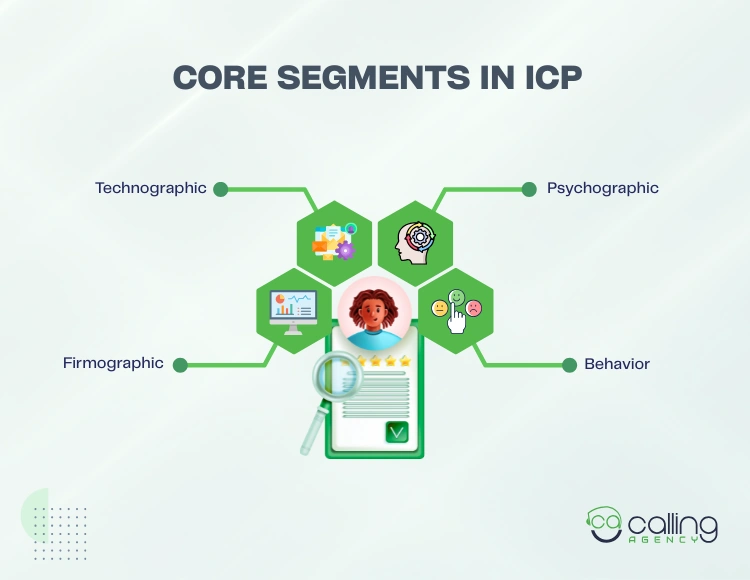

Core Segments in ICP

The core segments used to build an Ideal Customer Profile (ICP) for businesses are firmographic, technographic, psychographic, and behavioral characteristics.

- Firmographic: Firmographic segmentation uses demographic data for businesses to define an ideal customer at the company or organizational level. For this, you should analyze the industry, company size, location, business model, and growth stage.

- Technographic: Focusing on the technology stack that target companies use, technographic segmentation is done. You should check software and tools, technology usage, and hardware to know their needs, digital maturity, and potential for integration with your product.

- Psychographic: Psychographic segmentation focuses on the psychological attributes and mindset of the individuals within an ideal customer organization. It helps to understand the “why” behind their behavior based on their values, lifestyle, interests, motivations, and goals.

- Behavior: Behavioral segmentation analyzes the actions and patterns of your ideal customer to understand their buying journey and how they interact with your brand. It is based on purchasing habits, brand interactions, product usage, and pain points and needs, and AI for CX can enhance this approach by delivering deeper behavioral insights and enabling more tailored customer interactions.

Pain Points to Mirror in Copy

You need to understand your target audience’s specific frustrations through research. Then, craft messaging that acknowledges and validates those struggles. By doing this, you can make your customers feel understood and build their trust before presenting your solution.

- Financial: Your customers may have problems with hidden or confusing fee structures, high transaction costs, cash flow delays, and costly and outdated equipment. Keep the pricing transparent, cash flow quick, and hardware updated to solve these.

- Technical: Technical and integration pain points include disconnected systems, reliability issues and downtime, and limited payment options. Make integrations easier, payment systems reliable, and expand payment options to solve these problems.

- Compliance: You must provide industry-compliant security measures, use necessary tools, and simplify PCI DSS requirements. Get rid of security and compliance pain points like vulnerability to fraud, excessive chargebacks, and complex PCI compliance.

- Support: Service and support pain points include poor customer service, difficult application and onboarding, and lack of transparency. To solve this, respond to customers quickly, speed up onboarding, and make straightforward agreements.

Positioning and Messaging

You need customer research and competitor analysis to understand your target market. This will help you define your positioning and create a unique value proposition. By doing this, you can create messages that clearly and consistently communicate this value proposition. You should also adjust it to suit different customer segments.

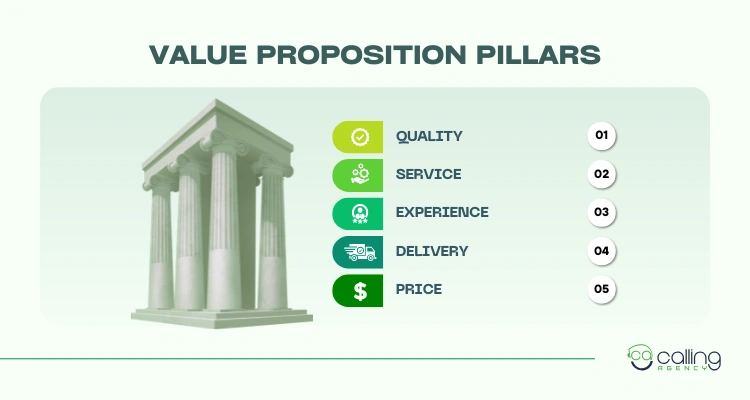

Value Proposition Pillars

Value proposition pillars focus on the core dimensions of quality, service, experience, delivery, and price from the customer’s perspective.

- Quality: Your reliability, accuracy, and consistency of the merchant services indicate your quality. For example, payment processing and transaction accuracy. The quality of your service plays the most important role in attracting and retaining customers.

- Service: You need to provide high-quality service. This involves responsive customer support, proactive problem-solving, knowledgeable staff, and personalized solutions for your customers. Your good service can increase trust and reliability.

- Experience: You can provide your merchant with a positive experience with ease of use, a smooth integration process, and user-friendly platforms and tools. Making the important processes easier keeps the customers coming back to you.

- Delivery: Focus on efficient and timely implementation of services, the speed of transactions, and the accessibility of data and reports. This makes your delivery effective, reduces customers’ frustration, and makes the work smoother.

- Price: Keep the pricing reasonable and transparent. Merchants consider the overall cost, including transaction fees, equipment costs, and any hidden fees, balanced against the value they receive.

Differentiators to Highlight

You need to show a merchant how your service directly addresses their pain points. By doing so, you build their trust and help their business grow. You may highlight the following key differentiators to achieve this:

- Pricing and Financial Benefits: Merchants are highly sensitive to costs. So, you need a clear and competitive pricing structure. You shall offer simple, transparent methods like flat-rate or interchange pricing, and show them how your solution reduces overall operational costs. You may also offer instant funding to improve cash flow.

- Improved Customer Experience: For merchants, the customer experience they provide is very important to their success. So, you must highlight your ability to accept all major credit and debit cards, digital wallets, and contactless payments. You also need to show them how fast your payment services are. Offer omnichannel solutions as well.

- Operational Efficiency: You need to show how your service integrates with the tools merchants already use. They value tools that help them speed up their operations and manage their business more effectively. So, you can offer reporting tools that provide valuable insights into sales trends, customer behavior, and key performance indicators. You may also customize your services based on specific industries.

- Security and Support: Reliability and trust are very important to a merchant’s peace of mind. To gain their trust, you can offer advanced fraud prevention tools, assist with PCI compliance, and offer responsive and attentive support. You can also use case studies and client testimonials. These can show how you have helped similar businesses succeed. It helps you gain their trust faster.

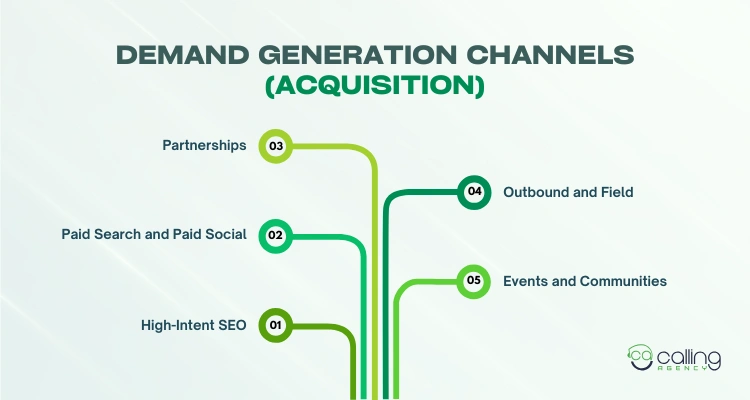

Demand Generation Channels (Acquisition)

You can use strategies and acquisition channels for content marketing, like blogs, webinars, and SEO, for demand generation. You can also use paid advertising like social media ads, search ads, email marketing, and social media engagement.

High-Intent SEO

You need a high-intent SEO strategy targeting potential clients who are actively researching, comparing, and ready to sign up for a payment processing solution. Content marketing, SEO, and outreach campaigns play a key role in capturing a credit card processing lead that is more likely to convert. For this, you need to create strategic landing pages and keywords, comparison content, optimize the website’s elements, and improve local SEO.

Paid Search and Paid Social

Social media is a powerful channel for lead generation. You need an integrated paid search and paid social strategy for merchant services to target prospects at both high and low intent stages of the sales funnel. You can use paid search to capture active demand from businesses ready to switch providers. Paid social, like LinkedIn or Facebook, can be used to build brand awareness and generate interest among potential leads.

Partnerships (ISV/VAR/Agent/Bank)

Partnerships with Independent Software Vendors (ISVs), Value-Added Resellers (VARs), Agents, and banks are necessary for you. All play different but related roles and allow you to connect merchants with payment processing solutions.

- Independent Software Vendor (ISV): An ISV creates specialized software for a particular industry. They partner with payment processors to embed payment functionality directly into their platforms. This provides merchants with a complete solution for operations and payment acceptance.

- Value-Added Resellers (VARs): A business that resells hardware or software, often bundling a payment solution with it, is known as VAR. Point-of-Sale (POS) VARs, for example, package POS systems with merchant services for retail and restaurant clients.

- Agents: Agents, also known as Independent Sales Organizations or ISOs, are independent sales representatives who sell merchant services on behalf of payment processors or sponsoring banks.

- Banks: Banks and other financial institutions partner with merchant services providers to offer payment processing solutions to their business customers. Since many small and medium-sized businesses look to their bank for all financial services, this can be a natural extension of the relationship.

Outbound and Field

The business development and sales strategies used to acquire new merchants by engaging with them outside of a traditional office setting are outbound and field strategies. Outbound lead generation involves proactively reaching out to potential clients using phone calls or email, in most cases. On the other hand, field sales involve in-person and face-to-face interactions with prospective merchants at their place of business.

Events and Communities

For merchant services, communities and events are available through major associations, industry-specific forums, and general fintech conferences. If you are a professional who wants to network and learn, joining a relevant association like the APP or a regional payment association is an excellent starting point. And if you are interested in large-scale industry trends, events like Money20/20 or Nacha’s Smarter Faster Payments conference provide a complete overview.

Content Strategy Map

A content strategy map includes identifying your target audience and their place in the customer journey, then mapping existing content to identify gaps and creating new content to fill these gaps. Optimization is needed for continuous improvement in the process.

Bottom-of-Funnel

You should focus on tactics that address their final concerns, reinforce value, and create urgency. This helps you capture merchants at the bottom of the funnel (BOFU). In this stage, merchants are already aware of their problem, have researched solutions, and are evaluating specific providers.

So now, you need to prove your expertise and build confidence. You can do this by accelerating the decision-making process, facilitating the final conversation, and speeding up the checkout process.

Mid-Funnel

The mid-funnel stage is the consideration phase. This is where merchants are aware of their business problem and are actively researching potential solutions. Now is the time when your marketing shifts from brand awareness to building trust.

At this stage, you must state why your specific solution is the best fit for your merchant. Top mid-funnel strategies you can use are content marketing, automated email campaigns, retargeting ads, social proof, and free tools and demos.

Top-Funnel

The top funnel is where you should focus on building brand awareness. You can do this by providing valuable content that educates and attracts businesses in the early stages of identifying their need for payment processing solutions.

Top-of-funnel (TOFU) tactics include blog posts, social media campaigns, infographics, and thought leadership articles. Through these, you can highlight industry trends and common challenges merchants face. This positions you as a trusted expert in the market.

Conversion Rate Optimization (CRO) for Payments Pages

You can use Conversion Rate Optimization (CRO) by simplifying the checkout process, offering diverse payment options, ensuring high website speed, building trust with social proof, and providing dedicated support channels. You must also use mobile optimization, personalized experiences, clear calls to action, and A/B testing to increase the percentage of visitors who complete a transaction.

Page and Form Fundamentals

To optimize payment pages, you should focus on simplifying the checkout process by reducing form fields, offering guest checkout, and ensuring mobile responsiveness. Implement high-quality visuals, provide detailed product information, and show strong social proof through reviews and testimonials. You must also use clear call-to-actions (CTAs), provide multiple support options, and use A/B testing to validate changes.

Offer Design

An offer design involves a combination of payment processing options, like credit card terminals, online gateways, or POS systems, etc., with essential features like fraud protection, customer management tools, and detailed reporting. Consider industry-specific needs, and present flexible pricing structures, such as flat-rate or tiered plans, that align with a business’s transaction volume and growth potential while creating an offer.

Pricing and Packaging

Effective marketing for merchant services requires a strategic mix of pricing and packaging that communicates value to different segments, using approaches like value-based, competitive, and good-better-best tiered pricing to meet diverse customer needs and price points.

Develop Core Pricing Strategy

You need to select your pricing strategy and move forward accordingly. A few pricing models are described below:

- Value-Based Pricing: This model focuses on the value your merchant services provide, such as increased efficiency or cost savings, and prices accordingly. This can justify higher prices for distinctive services.

- Competitive Pricing: As per the name, this model sets your prices based on what your competitors are charging. This requires understanding your market position and brand value.

- Cost-Plus Pricing: This pricing model calculates the cost of your services and adds a desired profit margin. This is straightforward but may not capture maximum customer value.

- Tiered Pricing: This model offers different packages or tiers with varying features at different price points, like good-better-best. This helps you appeal to a broader range of customers and encourages upselling.

Packaging Strategies

Packaging services to highlight their value to specific customer segments through clear value propositions, feature bundling, and tiered offerings. Define your value proposition, segment your customers, bundle features, create a messaging framework, develop collateral and content, and highlight tangible value.

Conclusion

To stand out in the merchant services industry, you require clear positioning, consistent communication, and strategies that resonate with the right audience. By combining digital marketing, targeted outreach, and value-driven messaging, you can attract quality clients and build long-term loyalty. With the right approach, your marketing creates long-term partnerships that drive growth and success in a competitive marketplace.

Looking for more marketing strategies to grow your business further? Stay connected with us and never miss an update!