If you run a business, it is substantial to find the best merchant services for your company’s needs. Unfortunately, choosing a merchant service provider from the many options on the market isn’t always intuitive. Here’s everything you need to know about selecting merchant services.

Merchant services is a broad term for various payment-related business support services and equipment. From payment processing to POS Systems, these services are essential for businesses involved in retail, e-commerce or any other commercial activity that requires payment transactions.

Regardless of which services and mechanisms are included, merchant service providers help merchants accept payments from customers as effortlessly and efficiently as possible.

Define Your Target

The merchant services provider is full of potential options for clients. There isn’t an exact count of the number of companies in the field, but a conservative estimate would be firmly in thousands.

Finding a niche and developing expertise within it can help attract clients as well as keep them on board. Your services become more than just generic merchant lead offerings; they’re targeted toward specific client objectives and needs.

A one-size-fits-all approach to selling merchant services rarely works. Each vertical has its unique challenges and requires you to be able to know them, understand them, and offer solutions to each one.

What is an Ideal Merchant

Let’s talk about merchants!

Merchants exquisitely consign to an individual entity or SMB that operates through multiple channels, like physical storefronts, e-commerce platforms, or B2B transactions. They serve as a bridge between the producers and consumers that facilitates the availability and exchange of goods and services.

Merchants contribute to the economic activity, satisfy consumer demand and add value through the provision of additional services like customization, delivery and customer support.

SMBs processing under $50k/month is an ideal POS option that includes Square POS, Shopify POS and Lightspeed POS. These systems are well-suited and offer affordable pricing, ease of use and industry-specific features for the retail businesses. This approach supports mobile transactions, manages inventory and can be scales as the business expands.

- Square POS- It is an ideal fit for businesses like retail, services and restaurants because of its low-cost entry point, mobile features and easy setup.

- Shopify POS- It is one of the best options for online e-commerce platforms due to its seamless integration.

- Lightspeed POS – This offers more advanced inventory and sales management features, which are significantly useful for retail businesses that require more detailed item tracking.

The Key Needs

As a merchant, identifying the key needs of your audience should be an integral part of your merchant services sales strategy, as it will ensure your messaging reaches the most receptive group of people.

Transparent Pricing

Your pricing strategy is an impression of your costs, benefits, and value of your product or service. Therefore, you should avoid any hidden fees or ambiguous terms that could lead to confusion or mistrust. When consumers can easily access and understand pricing information, they are better equipped to compare options and select the best value.

Fast Funding

By using this method, you can employ free and budget-friendly research methods, such as analyzing existing customer data, surveying your audience, and researching competitors’ online strategies and social media presence. You can also leverage tools like Google Workspace Forms, social media insights and census data from free online resources to gather demographic and behavioral information quickly.

Support

You can initiate by trying to understand the value of your product and the solution it offers for the issue. Collect data through customer surveys and competitor research to identify demographic information and psychographic traits (age, interest, lifestyle, value, etc.) to gain a better perspective. You can use this information to tailor your marketing messages and select the most adequate channels to reach your ideal customers.

PCI Help

As the annual transaction volume increases, there will be changes within PCI levels. PCI is a series of standards that establish what a merchant or business needs to do to ensure they’re handling credit card information appropriately.

All you have to do for PCI compliance is complete and file a self-assessment questionnaire each year, along with records of the scans that are required of your payment network. There may be some additional paperwork required, but it should all be relatively straightforward for businesses to complete.

Your payment processor should have hefty reporting tools that allow you to see how many transactions you’ve processed. Being too low can result in fines. Being too high means you’re paying for things you don’t need to.

The Art of Persuasion in Selling Merchant Services

Merchants and their businesses thrive when customers understand precisely what’s on the table. A clear and constraining offer will leave no room for misinterpretation. It explicitly decodes what the customer is receiving, the cost, the delivery method and any additional terms or conditions.

By elevating your persuasive skills, you will be able to increase your conversion rates and build trust and loyalty that lasts. Generic sales scripts won’t cut it in the nuanced world of merchant services sales strategy. However, you can create merchant services sales scripts that serve as a rough guide while still allowing for flexibility and personalization.

Pricing Model: Interchange-Plus, No Surprises

Handling objections is a crucial part of the sales process, especially when it comes to merchant services. Common objections usually include cost concerns, security and complexity of switching payment processors.

Instead of uncertain promises, offer a clear and detailed comparison that highlights how pricing is more advantageous. Compare it with the current setup and emphasize the long-term savings and benefits that you will be offering.

Example Mock-up: Transparent Fee Structure Breakdown

Merchant’s Current Payment Processor: XYZ Payments

- Monthly Fee: $50

- Transaction Fee: 2.9% + $0.30 per transaction

- Chargeback Fee: $25 per incident

- PCI Compliance Fee: $10 per month

- Annual Fee: $120

Total Monthly Cost for a Merchant Processing $10,000 in Sales and 500 Transactions:

- Transaction Fees: $290 (2.9% of $10,000) + $150 (500 transactions x $0.30) = $440

- Monthly Fee: $50

- PCI Compliance Fee: $10

- Average Monthly Chargeback Costs: $25 (assuming one chargeback)

- Total Monthly Cost: $525

Your Payment Processor: ABC Merchant Services

- Monthly Fee: $30

- Transaction Fee: 2.5% + $0.25 per transaction

- Chargeback Fee: $15 per incident

- PCI Compliance Fee: $0 (included)

- Annual Fee: $0

Total Monthly Cost for a Merchant Processing $10,000 in Sales and 500 Transactions:

- Transaction Fees: $250 (2.5% of $10,000) + $125 (500 transactions x $0.25) = $375

- Monthly Fee: $30

- PCI Compliance Fee: $0

- Average Monthly Chargeback Costs: $15 (assuming one chargeback)

- Total Monthly Cost: $420

Savings Comparison:

- Merchant’s Current Processor: $525 per month

- Your Processor: $420 per month

- Monthly Savings: $105

- Annual Savings: $1,260

It helps see the value in your offer and alleviate concerns about any hidden costs, making your pitch more compelling and trustworthy.

What’s Included: Equipment, PCI Guidance, Support and Timeline

How can you be sure that these online service providers, who readily accept and retain your credit card information, are taking the necessary measures to secure it? PCI compliance helps prevent fraud and data breaches, and is a collective effort that requires businesses to remain vigilant.

- Equipment- It includes firewalls, anti-malware software, secure systems and network security controls. These are essential tools to control and detect systems against any vulnerabilities.

- PCI Guidance- This guidance system provides security standards, risks assessments, develops policy and qualifies security assessors.

- Support – Help with designing and implementing security controls and policies, training, ongoing monitoring for security systems and incident response

- Timeline- The timeline consists of defining the PCI level, scope definition, implementation phase, assessment and reporting and continuous monitoring to maintain compliance

Prospecting That Works

Prospecting is where every deal starts and where most salespeople struggle. It takes time, consistency and often, a lot of rejection. When you merge sales prospecting with a data-driven strategy, you become unbeatable.

Prospects are a bit further down in the funnel. They have a vested interest in your offering, have a challenge that you can help solve and are interested in contact beyond signing up for an email list or following you on social media.

Warm Networking

This strategy leverages your existing personal and professional relationships such as friends, family and colleagues to generate business leads and opportunities. Starting with warm networking makes the prospecting process less daunting, especially for those who are new to sales or network marketing.

Referrals From Happy Clients

Referrals often lead to the most qualified prospect conversions because they come with high trust and credibility that gets passed directly towards you. Referrals are word-of-mouth marketing on steroids.

The person referring your brand has already done the heavy lifting, vouching for your credibility and value. This reduces the skepticism that usually comes with a cold outreach method.

To leverage referrals, use these tips:

- Ask For Referrals At The Right Time

- Track And Reward Referrals

- Make The Referral Process Easy

Almost every company with a digital presence is available on LinkedIn, making it an ideal social platform, and you can use LinkedIn’s powerful search feature to quickly narrow down companies that are a perfect fit. But first, you’ll need a Sales Navigator account. You’ll need to pay, but it’s worth the cost if you do any prospecting on LinkedIn.

Partnerships

Partnerships with CPAs, POS dealers, web agencies, and Chambers of Commerce create valuable opportunities, offering revenue benefits such as partner pricing, professional development, strategic insights, and access to specialized services for employees and members. This simultaneously provides strategic advantages and leads to lead generation for the partnering organizations.

Events/Lists

In order to identify high-demand industry niches, you need to focus on a list of events within one or two verticals. Select the types of events such as conferences, webinars or trade shows, that align with your chosen niche’s audience and business goals.

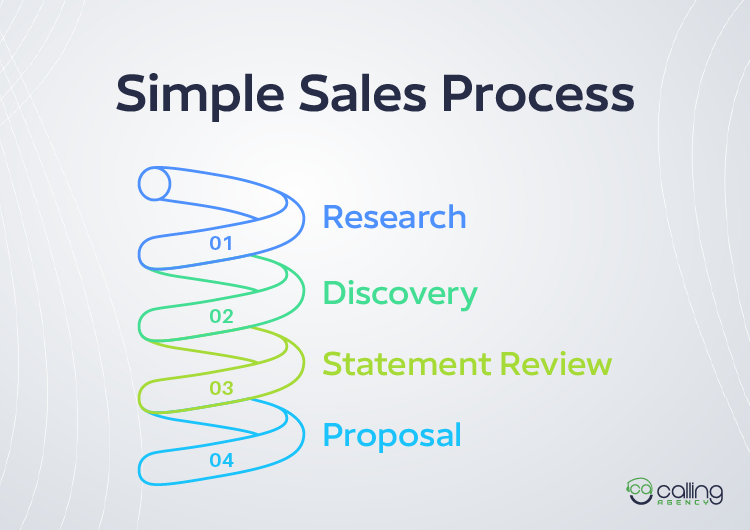

Simple Sales Process

Sales processes can vary depending on the complexity and length, especially for B2B, which can entail multiple buyers and commitment. Implementing a sales process can increase efficiency, improve customer service, easily onboard new sales reps, boost sales performance and qualify and optimize your sales system.

Research

Research is not just checking a LinkedIn page and calling it a day. It’s about understanding the company’s context, what they care about, where they’re going, and how you fit into that picture. Without this step, you’re not selling solutions; you’re guessing. The research process focuses primarily on three layers:

- Speak To Others At The Prospect’s Company

- Google The Industry And Business

- Interview Current Customers With Similar Needs

Discovery

This is the stage where a salesperson learns about a prospect’s problem, needs and goals to determine if their offering is a good fit. This step allows for a tailored and value-based approach instead of just simply selling features that set the foundation for the entire sales cycle.

Statement Review

It is a core activity within “Preparation and Research” where the salesperson analyzes customer information, needs and the overall proposal to ensure the subsequent pitch and provide effective and customized buyer’s specific situation and financial capacity. This contributes to the foundation for understanding the consumer’s sphere.

Proposal

The proposal stage should be tailored according to each prospect. This is usually a product demo, slide deck or a one-pager that outlines the details of the engagement. This stage basically shows why you are a good fit for their company.

- In-person demo

- Schedule meetings

- Walk through your proposal

Mastering the Economics of Competitive Pricing Decisions & Rules

Cost-conscious merchants offer flexible pricing options that include flat-rate models, subscription-based plans, and dual pricing to meet the varying needs of their customers. Transparency in pricing builds trust and augments your chances of closing deals with your potential consumers. This strategy is a continual process that requires adjusting prices to stay competitive.

There are three golden rules for setting the perfect price:

- Your price must be perceived as a good value.

- Your price has to be affordable to your target market.

- You must understand the economics of your price even if you decide to sell at a loss.

Prefer Interchange-Plus Over Tiered

Merchants usually incline towards interchange plus over tiered pricing because it is more transparent, showing them the exact interchange fee set by card networks plus a fixed processor markup for each transaction.

Tiered pricing conceals costs by segmenting transactions into ‘qualified,’ ‘mid-qualified,’ and ‘non-qualified’ categories, often leading to a higher and unpredictable fee structure. While Interchange-Plus seems complex initially, it provides a detailed cost breakdown, helping businesses understand their true costs, find savings, and negotiate better, which makes it a more effective model for controlling expenses and avoiding overcharges.

Surcharging

Credit card surcharging is a dynamic pavement for businesses to offset the cost of accepting credit card payments. Merchants also need to notify customers at the POS and on their receipts, often requiring specific signage to disclose the surcharge as a merchant fee.

PCI DSS 4.0

Merchants need to identify their merchant level in order to understand the requirements, conduct a gap analysis for the assessment of the current security posture, manage their Cardholder Data Environment, implement controls, multi-factor authentication and script management, provide security awareness training for staff and submit Self-Assessment Questionnaires (SAQs) and Attestation of Compliance (AOCs) to their payment acquirer or payment brand.

Keep and Grow Accounts

By fostering a strong relationship with your consumers, you can increase retention, encourage referrals and build a reputation for reliability and quality. This strategy involves understanding your clients, tailoring your solutions and support, identifying new opportunities and optimizing your performance to maintain their loyalty and grow your revenue.

First 90 Days

To keep and grow a client account in the first 90 days, concentrate on creating a structured onboarding process with regular check-ins to gauge satisfaction and progress. Ensure the account team is trained on PCI tasks and procedures and provide refreshers to strengthen relationships and show value.

Add-Ons

Using invoicing helps streamline payments, loyalty programs encourage repeat purchases, analytics provide crucial business insights, and BNPL offers flexible payment choices to new and existing customers. Key integrations connect your e-commerce platform with other essential systems, which creates a seamless user experience for both customers and merchants.

Quarterly Reviews

Merchants usually conduct quarterly reviews that include the cornerstones, which are key performance indicators (KPIs) such as approvals, Chargebacks, Funding Speed, and Upsells. By regularly analyzing these metrics, you can pinpoint areas of improvement and amplify customer satisfaction.

Metrics to Track Weekly

Tracking the right metrics is crucial for evaluating performance and making informed decisions. To ensure you’re maximizing the ROI of tools, teams, and customer relationships, zero in on sales key performance indicators (KPIs) that make the most of what you have while delivering recurring revenue.

Meetings Booked, Proposals Sent, Win Rate, Cycle Time

Meetings Booked, Proposals Sent, Win Rate, and Cycle Time are key sales and process metrics that track a sales team’s progress and effectiveness. Meetings Booked shows the number of outreach efforts, Proposals Sent indicates potential opportunities, Win Rate measures the success rate of those proposals, and Cycle Time evaluates the efficiency of the entire sales process or a specific part of it.

After closing a deal, calculate the savings compared to their previous service provider, then average the amount across all closed deals each week. Also, track how many referrals came from the existing customers and partners.

Conclusion

The payment processing industry is projected to soar to $530.61 billion in the U.S. alone by 2029. This presents a massive opportunity for businesses in this space if they know how to effectively generate sales leads.

Merchant service providers are important partners in the task of processing payments. Consistently meet the needs of clients in terms of the foundational merchant services you provide, as well as in customer service, support, troubleshooting, and all other relevant aspects of operating as a service provider.

You should proactively keep looking for opportunities to provide better support, keep costs for clients manageable and deliver improvement in services over time.