The insurance industry is always evolving, and the competition for higher efficiency is increasing along with it. Since not all leads are equal, your sales agents have to transform raw data into data-driven insights. That’s when the lead scoring comes into play. It’s one of the best tools to speed up your lead generation process.

It uses numerical scores to determine your sales readiness and conversion probability. Your sales and marketing teams evaluate such scores based on various factors, like interaction with your online presence, information your prospects have submitted, etc.

Lead scoring services for insurance firms use data-driven models to rank and prioritize leads based on the likelihood to buy. Your insurers can streamline follow-ups, reduce sales friction, and close more policies easily by combining behavioral insights with firmographic and demographic data.

This blog will help you understand more about the importance of lead scoring in commercial insurance, foundational requirements for your effective lead scoring, how to create a sample scoring model framework, and more.

What Is Lead Scoring in Commercial Insurance?

Lead scoring is a process of evaluating your leads based on their characteristics and behaviors to determine their level of interest in purchasing insurance products. It typically involves specific criteria relevant to your business’s industry or customer base.

It also assigns a numerical value (usually 1-100) based on your leads’ attributes, like demographic information, online behaviors, or engagement with marketing activities. Your insurance agents can segment leads into different groups, like hot, warm, or cold leads, by analyzing such factors.

Lead scoring helps your insurance agents identify potential customers who are more likely to need their services and purchase an insurance policy. Your agents can quickly discover leads with the highest potential value by assigning points to relevant interactions, like filling out a policy form or responding to a targeted email from your company.

Demographic Features

For demographic information, you should look for age, income, occupation, location, industry size, etc, to get valuable insights into a lead’s potential as a customer. You will be able to research this data online, through social media, or by using an online form. Let’s say a lead who matches your targeted demographic for a specific insurance product can be assigned a positive score.

Behavioral Data

If you want to measure how your prospects are interacting with your company’s service, use their behavioral data. You can track their online activities, like visiting your company’s website, downloading content, opening your emails, or social media posts. Let’s say leads who show active engagement with insurance-related content are more likely to convert and can be prioritized as a result.

Interaction History

It’s necessary to examine the history of interactions between your lead and insurance company. You can look for past queries, quotation requests, or previous policy history to get valuable contexts for lead scoring. For instance, leads who have a history of engagement with your company’s offerings can get a higher score.

Lead Source

Your source from which your leads were collected can also affect the likelihood of your conversions. You can take those leads as an example, which were generated through referrals or inbound marketing, and can be more qualified than those leads obtained through other methods, like cold calls.

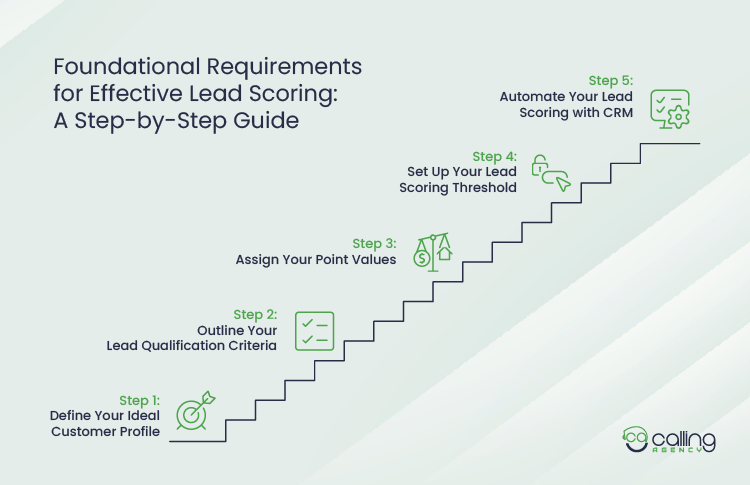

Foundational Requirements for Effective Lead Scoring: A Step-by-Step Guide

Lead scoring is much more than just a numbers game and marketing strategy. You can make your entire commercial insurance business more effective and align many teams in your company with lead scoring. Research has shown that companies using lead scoring can see a surprising 70% improvement in ROI of lead generation efforts compared to those companies that don’t use lead scoring.

This system works like a filter that helps your insurance agents in commercial insurance lead generation and identifying which leads have the best chance to convert quickly. It also assists your insurance agents in allocating resources more efficiently, reducing wasted efforts on unqualified prospects, and speeding up the sales cycle.

You can understand your prospects’ journey and rank them based on their likelihood to purchase simply by implementing lead scoring in your insurance sales cycle. You can build your effective lead scoring framework by defining your ideal customer profile, assigning points to your lead attributes, setting a threshold for your qualified leads, and more.

Step 1: Define Your Ideal Customer Profile

You should have a clear understanding of the characteristics that make your prospect a suitable fit for your insurance products and services. Your ideal customer profile should be made up of criteria collected from quantitative research, narrative observations, and existing customer data.

You should start by analyzing your existing customer base to find common characteristics, like firmographics( company size, industry), demographics (age, job title, etc), behaviors (buying habits), and more. Therefore, you can identify your ideal leads by keeping these questions in mind.

Who are my existing customers?

Determine your profitable customers who promote your insurance products or services.

What is their pain point and needs?

Understand the challenges your prospects face and how your insurance service can solve their pain points.

What industry do they belong to?

Identify the sectors where customers work to target leads in similar industries.

What is their job title and role?

Know the role of your ideal customers, if you’re targeting CEOs, managers, or CFOs. It will improve your marketing efforts.

What is their buying behavior?

Find out what factors influence their purchasing behavior and how long their buying cycle is.

Step 2: Outline Your Lead Qualification Criteria

Your lead qualification criteria are the factors that you can use to evaluate whether a lead is a good fit for your insurance product or service.

It’s better to use:

- Firmographic information, like industry, company size, location, etc.

- Also, you can track engagement and behavioral activities, like visiting your high intent pages,e.g., quote requests, or contact forms, engaging with your emails, etc, to qualify leads.

Furthermore, you should implement a BANT framework to get answers to your specific questions while qualifying leads. You can work with those leads who are eager to get insurance services from your company.

- Start with their budget, whether they can afford your insurance service.

- Authority, if your lead has the power to make the buying decision.

- Need, if your prospect has the necessity for insurance

- Timeline, whether your prospect is ready for the insurance service.

Step 3: Assign Your Point Values

Compare your conversion data for key lead attributes with your overall conversion data. For example, you might find your conversion rate for insurance webinar attendees is 15%, while your overall conversion rate is 30%.

Create your ranked list of attributes to see how positive or negative their impact on your conversions is. You can rank them based on their impacts. Let’s say a lead from a high conversion industry, like “technology”, can be worth 20 points, whereas a lead from “retail” can get -10 points, since it has low conversion.

You can set your point buckets by using a scale,e.g., 0-100, and assign your point ranges. Let’s say high impact might be 10-15 points, medium 5-9, and low 1-4. Award your positive points for completing desired actions, like filling out a quote form and give negative points for undesirable actions, like unsubscribing from your emails.

Step 4: Set up Your Lead Scoring Threshold

Lead scoring thresholds are a quick and easy way to group your leads into buckets based on how “valuable” they are. They’re strong prioritization tools that your insurance agents can quickly prioritize “hot leads” before moving to “warm” and “cold” leads.

Now it’s time to define your score limit for each category of lead. Let’s say prospects with 0 to 35 would be considered cold leads, 36 to 64 would be viewed as warm leads, and 65 to 100 would be regarded as hot or sales-ready leads.

For better lead scoring, segment your leads into different stages using multiple thresholds, such as “Marketing Qualified Lead” (MQL) and “Sales Qualified Lead” (SQL).

You can determine a lead’s score by adding up the points associated with their profile after you’ve collected and segmented your leads. For example, using the points above, a manager at a <50-person company in the insurance industry who attends a webinar would have a score of 60 (20+20+20).

Step 5: Automate Your Lead Scoring with CRM

Once you’ve set your lead scoring threshold, you should connect this data to your sales CRM system. This system will send you a real-time notification when your lead meets the point threshold. It allows you to follow up with them before a competitor does.

A strong CRM system offers much more than just data storage. It provides a range of advanced features to improve operational intelligence and lead quality throughout your insurance value chain. It supports customizable lead scoring models that help your insurers determine and improve the algorithm according to your business priorities.

You can also combine your CRM system with AI and machine learning for predictive lead scoring. Whether it is built into your CRM or a separate tool, a predictive lead scoring model is meant to work with CRM. It will be easier for your sales team to focus on the leads that AI has predicted and have the highest chances of conversion.

Sample Scoring Model for Commercial Insurance: A Lead Scoring Model Framework

Every business has its own scoring system for leads. One of the most popular techniques is to develop a value system and determine how many points each attribute is worth analyzing data from prior leads. Your sales reps can often get overworked with a long list of leads that makes it harder to prioritize the ones that wil actually convert.

That’s when the lead scoring model comes into the scenario. It helps your business determine which leads are worth pursuing and which are a waste of time. It also makes sure that the points you assign to each lead are accurate and represent their compatibility with your offerings.

A lead scoring model begins with selecting the appropriate attributes. It combines demographic and behavioral data to give each lead a numerical value. It’s not uncommon to create separate models for each customer segment.

Demographic Model: Fit Score Criteria

These attributes are related to your prospect’s individual characteristics, such as job title, age, gender, etc. It also combines attributes like your prospect’s company size, industry, annual revenue, etc, which are also known as firmographic data.

You can use these data as fit score criteria to determine your prospect’s demographic scoring and check whether the individual falls into your agency’s target buyer profile.

Here’s a breakdown of what a demographic sample model might look like.

| Criteria | Example Attribute | Point Range | Rationale |

| Industry | Manufacturing, construction, logistics | +15 | These industries have high commercial needs |

| Company Size | 25-250 employees | +10 | Mid-sized companies often need custom coverage |

| Annual Revenue | $2M-$20M | +10 | It indicates your prospect’s financial capability and policy needs |

| Location | Operates in the states where you’re licensed | +5 |

Your prospect’s regulatory fit |

| Decision Maker Role | Owner, CFO, Risk Manager | +10 | Direct influence on your leads’ purchase decision |

Behavioral Model: Engagement Score Criteria

These attributes reflect your prospect’s interactions with your insurance product or service. These behaviors give you insight into your prospect’s interest level and readiness to purchase.

It will show a higher conversion rate if your lead shows more engagement.

You can track engagement to detect your lead’s buying signals. These are form completions (e.g., quote requests, resource downloads, etc), website page visits (e.g., product pages, pricing, etc), email interactions, content engagement, call or meeting booked, and more.

You should assign a point value to each of your leads. Leads with a high score move to sales faster. However, leads with a lower score stay in your sales funnel for more nurturing.

Here’s a breakdown of what a behavioral sample model might look like.

| Behavior | Example Action | Score Range | Interpretation |

| Website Activity | Visit your product pages, pricing | +10 | Shows your research stage |

| Form Submission | Request for quote, callback, or demo | +15 | Your High intent |

| Email Interaction | Opens or clicks insurance email campaigns | +5 |

Your lead’s moderate interest |

| Content engagement | Downloads guides like “PolicyComparison” | +10 |

Your lead evaluating options |

| Call or Meeting Booked | Schedules or completes conversion | +20 | It shows your leads are sales-ready |

Final Thoughts

From the discussion above, we explored that lead scoring is an effective and powerful tool that not only prioritizes your leads, but optimizes your sales and marketing efforts as well for the highest conversions. It allows your teams to focus their efforts on leads that are ready for purchase.

It’s a strategy that needs key criteria, like demographic insights, behavioral engagement, etc. Implementing a lead scoring system can benefit your insurance company in many ways. It increases your conversion rates, shortens your sales cycles, improves your customers’ experience, and more. That ultimately drives your company’s overall growth in the competitive industry.