Commercial insurance is not a quick or easy sale. It protects entire businesses, not just one person.

Because the risk and cost are high, buyers must move slowly and carefully.

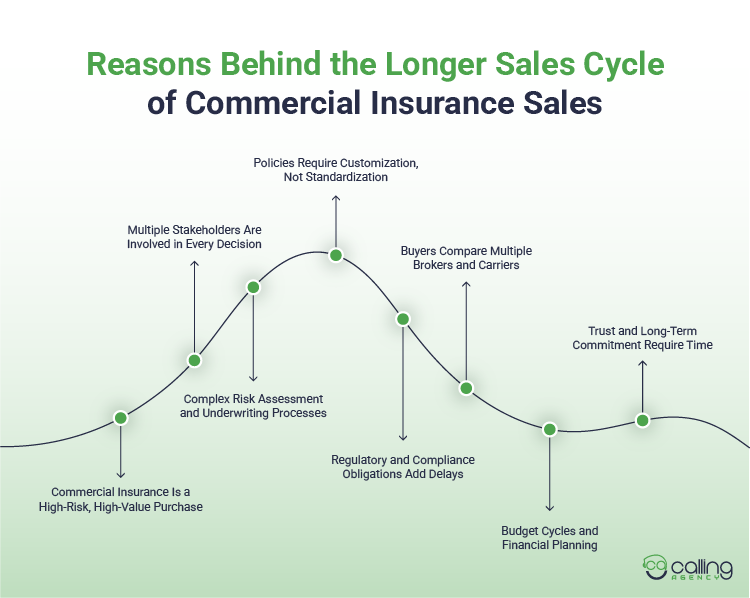

In this blog, we explain why commercial insurance sales cycles are longer, including:

- High financial and legal risk for businesses

- Multiple decision-makers are involved in every purchase

- Custom coverage needs instead of fixed plans

- Long underwriting, compliance, and legal reviews

- Budget planning and approval delays

- Trust-building with brokers and carriers

Each step is important for business safety. Buyers want the right coverage, the right price, and the right partner.

These careful checks protect the business but add time. This guide breaks down each reason in a simple way, so you can clearly understand why commercial insurance decisions take longer.

8 Reasons Behind the Longer Sales Cycle of Commercial Insurance Sales

Commercial insurance sales take time for many reasons. Rules, budgets, trust, and comparison all play a role. Buyers must review laws, costs, and partners carefully before deciding. Also, commercial insurance marketing methods vary based on the buyer’s business demands.

1. Commercial Insurance Is a High-Risk, High-Value Purchase

Commercial insurance covers the entire business. Commercial insurance safeguards everything. It runs through people, property, money, and day-to-day work. This fact makes an insurance sale high-risk. The wrong decision can hurt the entire company, not just one individual.

Key factors that contribute to this extended sales cycle are:

- Policies protect large business assets

- Errors in coverage can translate into large financial losses

- Legal and contractual risks are at stake here

- Compared with personal Insurance, premiums are more expensive

Commercial insurance leads, or buyers, are moving slowly because the risk is high. They read policy terms carefully. They ask a lot of questions and compare options. They are also reluctant to risk incurring further loss or running afoul of the law.

But these commercial coverage decisions also have long-term consequences. A policy can remain in effect for many years. That adds to the doubt when it comes time for buyers to sign.

This complete review process is a large part of why commercial insurance sales cycles are longer.

2. Multiple Stakeholders Are Involved in Every Decision

Commercial insurance is a multiple-person decision. Lots of people within the business need to review and sign off on the policy. This adds time at every step.

Common stakeholders include:

- Business owners and executives

- Finance and accounting teams

- Risk managers and safety teams

- Legal and compliance advisors

Both groups see the policy from a different angle. Owners focus on protection. Finance teams consider cost and value. Risk managers inspect business risks. Attorneys scrub rules and laws.

It takes time to get everyone on the same page. Meetings are scheduled. Feedback is shared. Changes are requested. One issue can hold up the entire process.

This process of decision-making by committee is slow. It is a main reason why B2B insurance sales cycles are longer than B2C.

3. Complex Risk Assessment and Underwriting Processes

Commercial insurance takes a long look at risk. Every business is different. A shop, a factory, and a tech company all have their own dangers to consider. This slows the process of underwriting commercial insurance down.

Underwriters often request:

- Financial records to check stability

- Historical claims to identify risk trends

- Details about operations and staff

- Safety steps and risk controls

Collecting this data takes time. Underwriters study it carefully. Many reviews are manual. Predictive risk models are applied to estimate future loss.

Brokers also rely on carriers and underwriters for approval. Once additional details are sought, the iteration goes through the loop again.

This is why such an exhaustive and thorough review is necessary to minimize risk. That is one of the reasons that a commercial insurance sales cycle is also longer.

4. Policies Require Customization, Not Standardization

Commercial insurance policies are not commodities. Each business will require coverage custom to its risks. This is a level of customization that can add time to the sales cycle.

Policy changes often include:

- Adjusting coverage limits

- Setting deductibles based on risk

- Adding special endorsements

- Removing or adding industry exclusions

The client, broker, and the carrier must all review any change. If one party requests updates, the policy is updated again.

These approval loops cause delays. Phone calls and emails, document review, so many of them. Nothing progresses until all parties reach an agreement.

Sales cycles are long, since commercial policies are customized. The additional time helps ensure strong protection, but also delays a final decision.

5. Regulatory and Compliance Obligations Add Delays

There are many rules that commercial insurance has to follow. These laws are based on state and federal regulations. For this reason, the purchasing process is delayed. Businesses cannot rush these steps.

It is common for the business to have commercial insurance compliance in order to begin a policy with many companies. Different industries have different rules. Examples are healthcare, construction, and finance, where standards are severe. Verify each of the rules very closely.

Delays happen because of:

- State and federal insurance laws

- Industry-specific compliance rules

- Contract terms with customers or suppliers

- Legal review before policy approval

Legal teams usually comb through the policy line by line. They want to ensure the coverage satisfies all laws and contracts. If anything is missing, adjustments are made.

All those reviews are protecting the company, but they are lengthening the sales cycle. Nobody wants fines, run-ins with the law, or contracts to be broken.

Buyers are slow to move because compliance is serious. This diligence is one of the main reasons that commercial insurance sales cycles are so long.

6. Buyers Compare Multiple Brokers and Carriers

Buyers of commercial insurance do not select the first option they see. They shop around. What they want is the best coverage at the right price. This stretches out the sales cycle.

Most buyers compare:

- Multiple brokers

- Several insurance carriers

- Different coverage options

- Price and value differences

Every broker has quotes from unique carriers. Each quote has different terms. Buyers have to check them one by one. This takes time and effort.

Buyers also consider carrier reputation. They are looking for a carrier that pays claims quickly. They look at coverage limits and exclusions. They shop for service quality and price.

Negotiation adds more delay. Buyers demand a better price or a better set of terms. Brokers go back to carriers. New quotes are created.

This tug-of-war can go on and on many times. Once again, due to this shopping and trading, the sales cycle for a commercial insurance policy is longer than normal polices.

7. Budget Cycles and Financial Planning & Slow Decisions

Commercial insurance is more expensive than personal insurance. For that reason, buyers should determine how much they can afford before making a decision. This slows down the sales process.

Most businesses require budget authorization for insurance. The cost of the policy must be within financial plans. Buyers can also sometimes be forced to wait until the next budget cycle.

Delays happen because of:

- Annual or quarterly budget reviews

- Policies tied to financial years

- Cash flow planning needs

- Approval from finance leaders

The policy itself is also often reviewed by CFOs and finance teams. They look at cost, value, and return. They can ask questions and request changes.

If the timing is off, the decision stops. The buyer could wait months for the money to be approved.

Insurance decisions slow down because money planning is time-consuming. This financial review is another point around why commercial insurance sales cycles are longer.

8. Trust and Long-Term Commitment Require Time

Commercial insurance is not a buy-once product. It is a long-term relationship. Buyers seek trustworthy partners. Building trust takes time.

Buyers look for:

- Broker knowledge and experience

- Carrier strength and stability

- Clear advice and honest answers

- Long-term service and support

Companies want to be sure the broker appreciates their risk. They want evidence that the carrier will write checks. They don’t want surprises down the line.

So, buyers do due diligence. They check reviews. They ask questions. They test communication and support.

This trust-building process cannot be hurried along. A bad decision can damage the business for years.

Buyers move at a freezing pace because commercial insurance is essentially relationship-driven. That trust and long-term security are a big reason why commercial insurance sales cycles take so long.

Final Words

Commercial insurance sales take longer because the risk is high and the process is complex. Buyers must review coverage, cost, rules, and trust before deciding. These extra steps protect the business. A longer sales cycle helps ensure the right coverage and long-term safety.